DSCR Loan Meaning: The Essential Guide for Investors

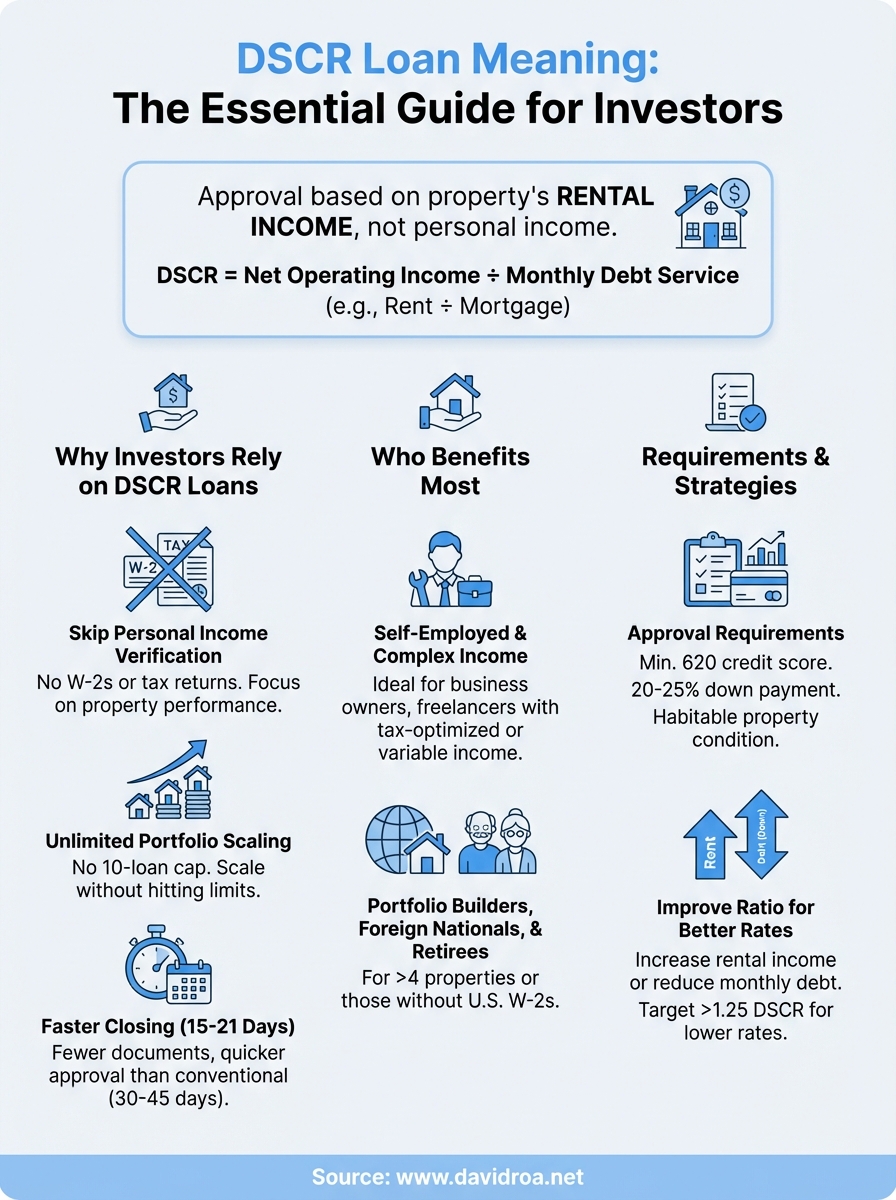

The DSCR loan meaning refers to a Debt Service Coverage Ratio loan where lenders approve your application based on rental income from the property instead of your personal income. You qualify by proving the property generates enough monthly rent to cover its mortgage payment and expenses. This makes DSCR loans powerful for investors who own multiple properties or have complex tax returns that traditional banks reject. The ratio itself measures how much rental income exceeds debt obligations, with a 1.0 DSCR meaning the property breaks even and higher numbers showing stronger cash flow.

This guide walks you through everything you need to know about DSCR financing. You'll learn why investors prefer this method over conventional loans, how to calculate your ratio accurately, and what requirements lenders expect during approval. We'll also cover specific strategies to boost your DSCR for better interest rates and show you exactly who benefits most from this approach. Whether you're building your first rental portfolio or adding to an existing collection of investment properties, understanding this financing tool gives you a competitive edge in real estate markets where speed and flexibility matter.

Why real estate investors rely on DSCR loans

Traditional mortgage applications force you to submit W-2 forms, tax returns, and employment verification that can take weeks to process. DSCR loans eliminate this paperwork burden by focusing solely on your property's ability to generate income. This shift in underwriting philosophy explains why the dscr loan meaning has become essential knowledge for anyone building a rental portfolio in competitive markets.

You skip personal income verification entirely

Banks ignore your job history, salary, and employment status when you apply for a DSCR loan. Instead, lenders analyze the property's rental income using current leases or market rent estimates from licensed appraisers. This approach works perfectly if you're self-employed, retired, or earning income from sources that traditional underwriters struggle to document. Your credit score still matters for rate qualification, but your personal cash flow stays out of the equation.

DSCR financing separates your personal finances from your investment strategy, letting properties stand on their own merit.

You scale your portfolio without hitting loan limits

Conventional financing caps you at 10 financed properties regardless of how profitable your rentals perform. DSCR lenders remove this restriction because they underwrite each property individually based on its debt coverage ratio. You can purchase your 15th, 20th, or 50th investment property as long as the numbers work. This unlimited scaling potential attracts experienced investors who generate consistent rental income but face arbitrary limits from traditional banks.

You close deals faster than competing buyers

DSCR loans typically close in 15 to 21 days compared to 30 to 45 days for conventional mortgages. You submit fewer documents, skip employment verification calls, and avoid the back-and-forth requests that delay traditional approvals. Speed matters when you're competing against cash buyers or need to lock in properties before market prices shift. Sellers prefer your offer when you demonstrate quick financing approval backed by property income instead of complex personal documentation.

How to calculate the debt service coverage ratio

You calculate DSCR by dividing your property's monthly rental income by its total monthly debt obligations. The formula is simple: Net Operating Income ÷ Monthly Debt Service = DSCR. If your property generates $2,500 in monthly rent and your mortgage payment (including principal, interest, taxes, and insurance) totals $2,000, you have a 1.25 DSCR. This number tells lenders you earn $1.25 for every dollar you owe, creating a 25 percent cash flow cushion.

What counts as net operating income

Lenders calculate your property's income using current lease agreements or market rent comparisons from licensed appraisers. You subtract operating expenses like property management fees, HOA dues, and insurance premiums from gross rental income to reach your net operating income (NOI). Most DSCR programs use 75 percent of gross rents as NOI to account for vacancy and maintenance costs. A property renting for $3,000 monthly gets calculated at $2,250 NOI under this standard approach.

Understanding the dscr loan meaning requires knowing that lenders prioritize property performance over your personal income statements.

What qualifies as monthly debt service

Your monthly debt service includes every payment tied to the property's financing. This covers principal and interest on your mortgage, property taxes, homeowner's insurance, HOA fees, and any additional liens or assessments. Lenders add these obligations together to determine your total monthly debt burden, which becomes the denominator in your DSCR calculation.

Who benefits most from this financing strategy

Self-employed business owners get the biggest advantage from DSCR loans because traditional lenders reject their tax-optimized returns and variable income streams. You avoid submitting two years of tax returns, profit and loss statements, or business bank statements that typically disqualify entrepreneurs who write off expenses aggressively. The dscr loan meaning becomes especially valuable when you own multiple businesses or receive income from partnerships, consulting agreements, or contractor relationships that confuse conventional underwriters.

Portfolio builders scaling beyond conventional limits

Investors who already own four or more financed properties hit brick walls with traditional mortgages that cap you at 10 total loans. DSCR programs let you acquire unlimited rental properties as long as each one generates sufficient cash flow to cover its debt obligations. You bypass the arbitrary caps that force successful landlords to pause their growth or resort to expensive private money lenders charging double-digit interest rates.

DSCR financing removes the artificial ceiling that stops experienced investors from expanding profitable portfolios.

Foreign nationals and retirees without W-2 income

International buyers purchasing U.S. rental properties can't provide domestic employment verification or U.S. tax returns. Retirees living off investment income, pensions, or retirement account distributions face similar documentation challenges with conventional lenders. DSCR loans solve both problems by focusing exclusively on property performance instead of your personal income sources or employment history.

What requirements lenders set for approval

Lenders verify your minimum DSCR ratio first, typically requiring 1.0 or higher before reviewing any other qualifications. You prove this through current lease agreements or market rent appraisals that demonstrate the property generates sufficient income to cover monthly debt obligations. Understanding the dscr loan meaning helps you recognize that while lenders skip personal income verification, they still enforce strict standards around credit quality, down payments, and property conditions that protect their investment.

Credit score and down payment thresholds

Most DSCR programs require a minimum 620 credit score, though rates improve significantly at 680 and 720 score levels. You need to bring 20 to 25 percent down for single-family properties, with higher requirements for multi-unit buildings or properties needing renovation. Lenders pull your credit report to verify you don't carry excessive debt balances or recent late payments, but they won't ask how you earn the money for your down payment.

DSCR approval focuses on property performance and borrower reliability, not employment documentation.

Property type and condition standards

Your investment property must pass a full appraisal inspection showing it meets habitable condition standards without major deferred maintenance. Lenders approve single-family homes, condos, townhouses, and small multi-family buildings (2 to 4 units) in most markets. Properties requiring extensive repairs or complete gut renovations typically don't qualify until you complete the work and stabilize rental income.

Strategies to improve your ratio for better rates

You boost your DSCR by increasing rental income or reducing monthly debt obligations before submitting your application. Lenders offer their best interest rates to borrowers showing ratios above 1.25, with premium pricing reserved for properties hitting 1.5 or higher. Understanding the dscr loan meaning reveals that small adjustments to either side of your calculation can unlock significantly lower rates that save thousands over your loan term.

Increase rental income through market adjustments

Your property's appraised market rent determines qualification even if you haven't raised prices on current tenants. You schedule lease renewals at market rates or wait until tenant turnover lets you capture higher rents before applying. Adding desirable amenities like updated appliances, fresh paint, or improved landscaping justifies $50 to $200 monthly rent increases that directly improve your DSCR without changing your mortgage payment.

Properties with documented rental increases or scheduled lease adjustments receive better rate consideration from DSCR lenders.

Reduce debt obligations before applying

You pay down existing balances on the property or eliminate second liens that inflate your monthly debt service calculation. Choosing a longer loan term spreads your payments across more years, lowering the monthly obligation that lenders divide into your rental income. Removing HOA properties from consideration or refinancing high-rate existing mortgages before applying creates immediate DSCR improvements without requiring rental income changes.

Final thoughts on asset-based lending

DSCR loans transform real estate investing by removing the documentation barriers that stop profitable deals from closing. You qualify based on property performance instead of personal income, which means your rental portfolio can grow without arbitrary limits or lengthy approval processes that favor W-2 employees over entrepreneurs. Understanding the dscr loan meaning gives you access to financing tools that traditional banks reserve for their most conventional borrowers.

Your success with this strategy depends on selecting properties that generate strong cash flow from day one. Properties with healthy debt service coverage ratios attract better interest rates and faster approvals, while borderline deals that barely break even limit your options and increase your risk. Focus on markets where rents support comfortable margins above your monthly debt obligations.

Ready to explore DSCR financing for your next investment property? Connect with our team at David Roa to review your specific situation and get pre-qualified in days instead of weeks. We specialize in helping investors close deals quickly with financing that works for your portfolio strategy.