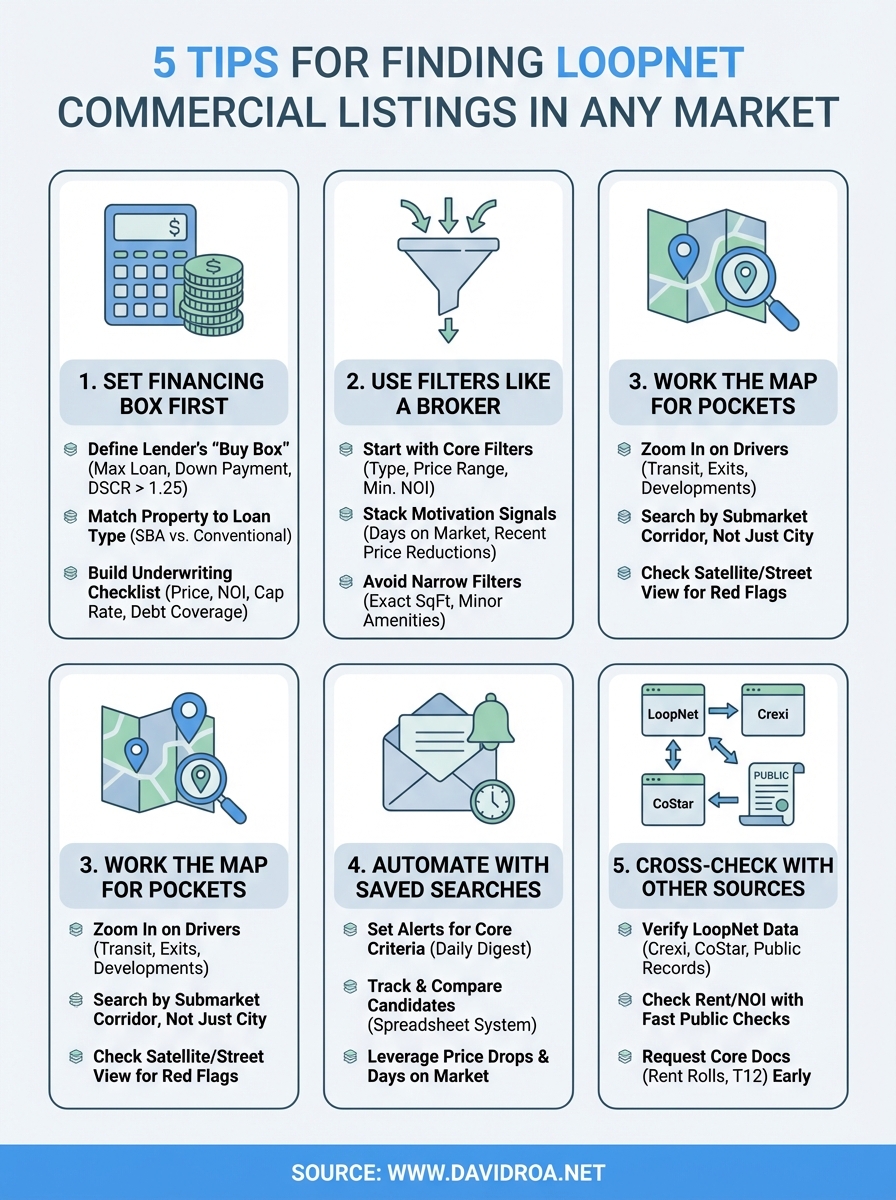

5 Tips For Finding LoopNet Commercial Listings In Any Market

Finding the right commercial property can feel like searching for a needle in a haystack, especially when you're navigating LoopNet commercial listings across unfamiliar markets. Whether you're eyeing a retail storefront, an office building, or a mixed-use investment property, knowing how to work the platform efficiently separates serious buyers from those who waste months scrolling.

LoopNet remains one of the largest commercial real estate marketplaces in the U.S., but it's not always intuitive. Many investors and business owners miss out on quality deals simply because they don't know the right filters, timing strategies, or how to evaluate listings against alternatives like Crexi or CoStar.

As a mortgage broker who has funded over $150 million in commercial and residential loans, I've helped countless clients move from property search to closing table. These five tips will help you find LoopNet listings faster, and position yourself to act when the right opportunity appears.

1. Set your financing box before you search

You waste time if you start scrolling through LoopNet commercial listings before you know what you can actually afford to close. The buy box is not about your dream property, it's about the hard numbers a lender will approve based on your financial profile. Most lenders work backward from debt service coverage ratio (DSCR), down payment, and cash reserves, and you need those parameters set in stone before you click search.

Define your buy box with numbers that lenders will use

Start by locking in your maximum loan amount and required down payment. Most commercial lenders require 20 to 30 percent down for stabilized properties, and closer to 35 percent for higher-risk assets like vacant buildings or new construction. Calculate your total purchasing power by adding your available cash to the loan amount, then subtract closing costs and immediate capital improvements. This gives you a realistic acquisition ceiling, not a wishful one.

Your DSCR target matters just as much. Lenders typically require a minimum DSCR of 1.25, which means the property's net operating income must cover 125 percent of annual debt service. Run this calculation for every listing you consider, or you'll fall in love with deals that never close.

Set your buy box around what you can fund today, not what you hope to qualify for later.

Match property types to the right loan options

Different property types require different loan products, and not all lenders finance every category. SBA 7(a) and 504 loans work well for owner-occupied commercial buildings like offices or retail spaces, but they won't cover pure investment plays. If you're targeting multifamily, retail, or industrial properties as non-owner-occupied investments, you'll need conventional commercial financing or DSCR-based loans that qualify on the property's income alone.

Specialty categories like mixed-use buildings often require hybrid underwriting. Know which lender programs align with your target property type before you refine your search.

Build a quick underwriting checklist for every listing

Create a simple checklist that includes purchase price, estimated NOI, cap rate, and debt coverage. Add fields for occupancy percentage, lease terms, and major deferred maintenance. This checklist turns browsing into evaluation, and it forces you to walk past listings that look attractive but fail basic financing tests. You should be able to disqualify 80 percent of listings in under 60 seconds once you know what lenders need to see.

2. Use LoopNet filters like a broker, not a browser

Most people treat LoopNet commercial listings like a real estate version of Zillow, scrolling through pages of properties without narrowing their focus. Professional brokers start with filters that eliminate properties they cannot close, then layer additional criteria to find motivated sellers. You should apply three to five filters maximum in your first pass, not twelve random selections that produce zero results or thousands of irrelevant listings.

Start with the few filters that cut the noise fastest

Lock in property type, price range, and minimum net operating income before touching anything else. These three filters remove 70 percent of the listings that do not fit your buy box. If you need owner-occupied financing, add the square footage filter to match SBA loan size limits. Avoid filtering by cap rate or price per square foot initially, as these metrics vary too much by market and can hide undervalued opportunities.

Stack filters that signal deal quality and motivation

Add days on market after your core filters are set. Properties listed over 90 days often have price flexibility or motivated sellers. Filter by recent price reductions to catch owners who need to move fast. These stacked filters turn your search into a pipeline of actionable deals, not a browsing session.

Avoid the most common filter mistakes that hide inventory

Never filter by exact square footage or narrow cap rate bands. Sellers often list ranges, and strict filters miss properties by a few square feet. Skip the amenities checkboxes unless they are deal breakers. Brokers know that filtering by parking spaces or loading docks eliminates properties where those features exist but were not checked in the listing form.

Filter to find motivated sellers, not perfect properties.

3. Work the map to find pockets other buyers miss

The map view on LoopNet commercial listings reveals opportunities that keyword searches and filters miss entirely. Most users zoom out too far or rely on city-level searches, which lumps strong submarkets with declining ones. You need to zoom in tight and search block by block around infrastructure, demographics, and recent development that signal real demand. The difference between a thriving commercial corridor and a vacant strip mall can be three blocks, and the map shows you which side of that line each property sits on.

Draw tight boundaries around real demand drivers

Zoom into specific intersections near new transit stops, highway exits, or mixed-use developments that are already leased and operational. Draw your search radius to 0.5 miles or less around these anchors. Properties within walking distance of established foot traffic or major employers command higher rents and maintain occupancy during downturns. Avoid the trap of searching entire zip codes, which dilutes your results with properties that share nothing but a mailing address.

Search by submarket signals, not just city names

Neighborhoods change faster than city-level data updates. Look for clusters of recent lease activity, new restaurant permits, or commercial construction that indicates capital is flowing into an area. These signals appear on the map before they show up in official reports or broker pitches. Search by corridor names or landmark addresses rather than broad municipal boundaries.

Spot location red flags that the pin does not show

Satellite view reveals issues the listing photos hide. Check for vacant neighboring units, deteriorating facades, or lack of parking that will kill your resale value or tenant demand. Look at street view to confirm the property matches its listing description and that surrounding businesses are actually open.

The map shows you what sellers do not want to emphasize in the listing narrative.

4. Turn LoopNet into a pipeline with saved searches

Manual searches waste hours you could spend analyzing deals or talking to sellers. Saved searches and email alerts transform LoopNet from a browsing tool into an automated pipeline that delivers qualified opportunities directly to your inbox. You set your criteria once, and the platform notifies you the moment a property hits the market that matches your buy box. This timing advantage lets you contact brokers and sellers before listings get buried under 50 other inquiries.

Set alerts that catch new listings before they spread

Configure email notifications for your primary search criteria, but limit yourself to two or three alerts maximum. Too many alerts create noise that you will ignore. Set alerts for your exact property type, price range, and target submarket, then choose daily delivery instead of instant. Daily digests let you review new LoopNet commercial listings in one focused session rather than interrupting your day with scattered notifications.

Build a simple system to track and compare candidates

Create a spreadsheet or document with columns for address, asking price, NOI, cap rate, and broker contact. Add each promising listing immediately after it appears in your alert. This running list becomes your short-term pipeline and lets you spot pricing patterns or identify which brokers control inventory in your target area.

Use price changes and days on market as leverage

Track days on market and price reductions for every property in your pipeline. When a listing drops price or crosses 120 days, you gain negotiating power that fresh listings never offer.

Properties that sit unsold create motivated sellers and room to negotiate below asking price.

5. Cross-check listings with Crexi, CoStar, and records

No single platform shows you the complete picture of a commercial property. LoopNet commercial listings provide a starting point, but relying solely on one source leaves you vulnerable to inaccurate data, hidden issues, and overpriced properties that savvier buyers already dismissed. You need to verify every major data point across multiple sources before you pick up the phone or submit an offer. Cross-checking takes 15 minutes per property and eliminates deals that would have cost you months of wasted effort.

Know what LoopNet does well and where it falls short

LoopNet excels at broad market coverage and early listing visibility, but it depends on brokers to input accurate data. Listings often contain outdated rent rolls, estimated NOI figures, or incomplete lease terms because brokers prioritize speed over precision. Use LoopNet to find properties, then verify financials elsewhere.

Verify rent, NOI, and occupancy with fast public checks

Pull county tax records to confirm assessed value and property taxes. Check local business registries for tenant names and verify they still operate at the address. Compare listed NOI against comparable properties on Crexi or CoStar to spot inflated projections.

Decide who to call first and what to ask for immediately

Contact the listing broker only after you verify core numbers. Request rent rolls, trailing 12-month financials, and current lease abstracts in your first conversation. Avoid properties where brokers refuse to provide documentation before showing the building.

Cross-checking protects you from deals that look good on screen but fall apart under basic scrutiny.

Your next move

Searching LoopNet commercial listings becomes productive when you combine platform knowledge with pre-set financing parameters and verification habits. Properties that survive your filters, map analysis, and cross-checking process deserve serious attention, not casual browsing. Apply these five strategies consistently and you will cut your search time by half while improving the quality of deals you pursue.

Start by defining your buy box with actual loan terms from a lender who understands commercial financing. This single step eliminates properties you cannot close and focuses your energy on opportunities that align with your capital and income requirements. Use filters strategically, work the map for hidden pockets of value, automate your search with saved alerts, and verify every major data point before you contact a broker.

Commercial real estate moves fast when you know what you need and how to find it. If you need financing that matches your investment strategy or business growth plans, explore commercial loan options that close deals on time.