Difference Between FHA And Conventional Loans: Pros & Cons

The difference between FHA and conventional loans comes down to who backs the mortgage and what you need to qualify. FHA loans are insured by the Federal Housing Administration and require lower credit scores and smaller down payments. Conventional loans are not government backed and typically demand higher credit scores but may cost less over time if you put down 20 percent or more. Each loan type has different rules for mortgage insurance, property standards, and qualification requirements that directly impact your monthly payment and closing costs.

This article breaks down how each loan works, what you'll actually pay each month, and which situations favor one over the other. You'll see side by side comparisons of credit requirements, down payment options, and total costs. We'll also cover property appraisal rules that can affect your offer strength and how sellers view different loan types. By the end, you'll know exactly which mortgage fits your financial situation and how to move forward with confidence.

Key differences at a glance

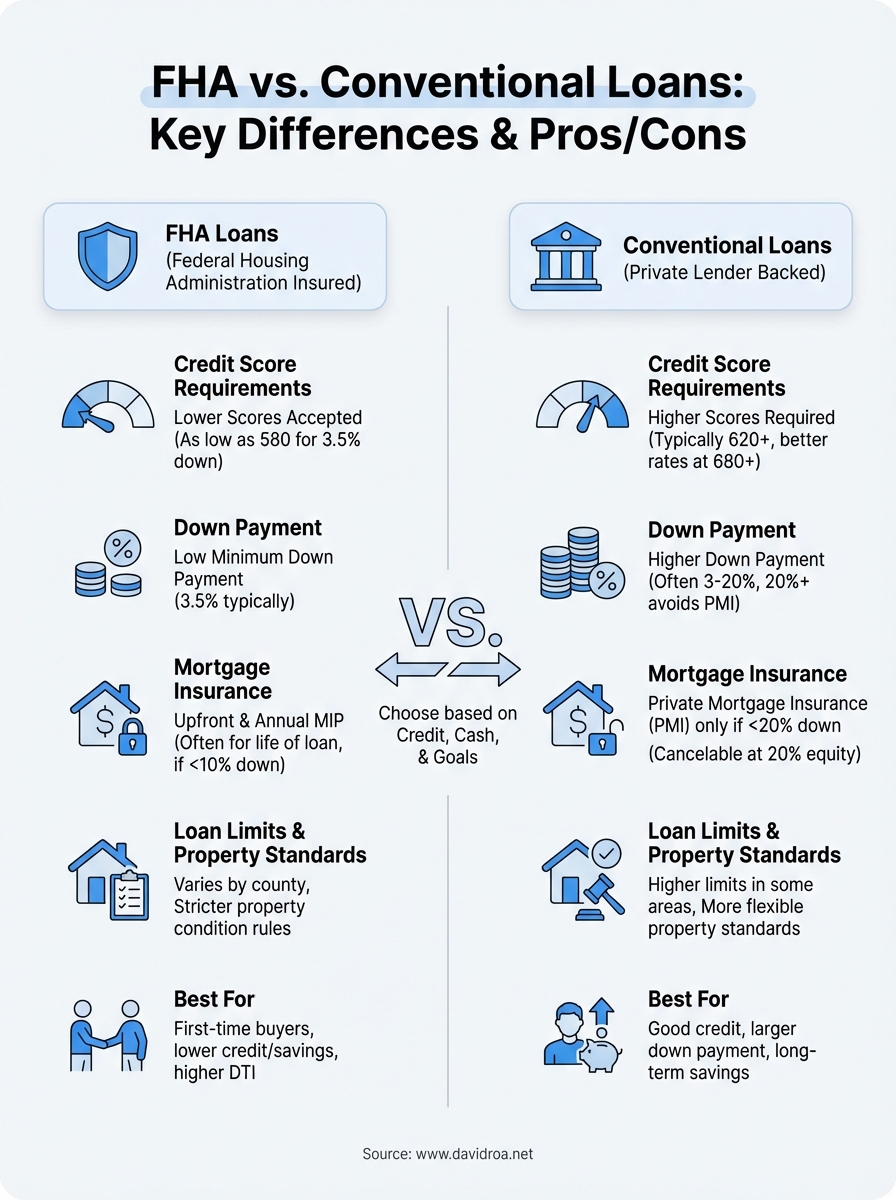

The difference between FHA and conventional loans shows up in five main areas: credit requirements, down payment minimums, mortgage insurance costs, loan limits, and property standards. FHA loans accept lower credit scores (as low as 580 for a 3.5 percent down payment) and require smaller upfront cash. Conventional loans demand higher credit (typically 620 or above) but drop mortgage insurance entirely once you reach 20 percent equity. Your choice between these two determines how much you need for closing, what your monthly payment looks like, and how quickly you can build equity without extra insurance costs.

Credit score requirements

FHA loans allow credit scores as low as 580 for the minimum 3.5 percent down payment option. You can qualify with a score between 500 and 579 if you put down 10 percent, though most lenders set their own minimums above this floor. Conventional loans require at least a 620 credit score for most programs, and you'll get better interest rates with scores above 680. The higher your conventional loan credit score, the more you save on rate, which can offset the difference in down payment over the loan term.

Down payment options

You can put down as little as 3.5 percent with an FHA loan on a purchase price up to the local loan limit. Conventional loans offer 3 percent down programs for first time buyers and certain income qualified borrowers, though these come with stricter credit and debt to income requirements. Both loan types let you use gift funds from family members to cover your down payment and closing costs. Conventional loans become more attractive at 10 percent down because you pay lower mortgage insurance rates than FHA, and they become significantly cheaper at 20 percent down when mortgage insurance drops off completely.

If you can manage a 10 percent down payment or higher, conventional loans typically cost less over time thanks to lower mortgage insurance rates and the ability to cancel that insurance later.

Mortgage insurance rules

FHA mortgage insurance has two parts: an upfront premium of 1.75 percent of the loan amount (usually rolled into your loan balance) and an annual premium that ranges from 0.45 percent to 1.05 percent depending on your loan term and down payment. You pay this annual premium for the entire life of the loan if you put down less than 10 percent. Conventional loans require private mortgage insurance (PMI) only when your down payment falls below 20 percent, and this insurance costs between 0.3 percent and 1.5 percent annually based on your credit score and down payment size. The key advantage is that you can cancel conventional PMI once you reach 20 percent equity through payments or appreciation, while FHA insurance sticks with you until you refinance.

Loan limits and property types

FHA loan limits vary by county and range from $498,257 in most areas to $1,149,825 in high cost markets for a single family home in 2026. Conventional conforming loans max out at $806,500 in standard areas and $1,209,750 in expensive counties. Both programs require the property to be your primary residence for standard qualification, though FHA allows you to buy a two to four unit property and live in one unit while renting the others. Conventional loans offer more flexibility for second homes and investment properties with higher down payments. FHA properties must meet stricter safety and habitability standards during the appraisal, which can create issues with fixer uppers or older homes that need repairs before closing.

How FHA loans work

The Federal Housing Administration doesn't lend you money directly. Instead, the FHA insures your mortgage so that approved lenders (banks, credit unions, and mortgage companies) take less risk when they approve your loan. This insurance protects the lender if you default, which allows them to offer more flexible qualification standards than they would for conventional loans. You pay for this protection through upfront and monthly mortgage insurance premiums that get added to your loan costs and monthly payment.

Government backing and insurance

When you apply for an FHA loan, your lender submits your file to meet FHA underwriting guidelines rather than conventional standards. The government sets maximum debt to income ratios (typically 43 percent but sometimes higher with compensating factors), minimum credit scores, and property condition requirements. Your lender still makes the final approval decision and funds the loan from their own capital. The FHA guarantee kicks in only if you stop making payments and the lender forecloses, at which point the insurance covers most of their losses. This system creates a safety net that encourages lenders to work with borrowers who have lower credit scores or smaller down payments.

Qualification requirements

You need stable employment history (typically two years in the same field) and income documentation that proves you can afford the monthly payment. FHA accepts W2 income, self employment earnings, Social Security, disability, and pension as qualifying income sources. Your debt to income ratio should stay under 43 percent in most cases, though some lenders approve up to 50 percent if you have strong compensating factors like significant cash reserves or a credit score above 620. Recent bankruptcies require at least two years of seasoning, and foreclosures need three years before you can qualify again. You must also show that you can cover closing costs and your down payment from your own funds, gift money from family members, or approved down payment assistance programs.

Best candidates for FHA loans

FHA loans work best if you have credit scores between 580 and 680 and can't afford a 20 percent down payment. First time buyers benefit the most because the low 3.5 percent down requirement gets you into homeownership faster. You also get an advantage with FHA if you carry higher monthly debt like student loans or car payments, since the debt to income limits stretch further than conventional programs. Understanding the difference between FHA and conventional loans helps you see why borrowers with credit challenges or limited savings choose FHA, even though the lifetime mortgage insurance adds long term costs.

FHA loans give you access to homeownership with less upfront cash and more forgiving credit requirements, but you pay for that flexibility through permanent mortgage insurance if you put down less than 10 percent.

How conventional loans work

Conventional loans get funded by private lenders like banks, credit unions, and mortgage companies without any government insurance backing them up. Lenders follow guidelines set by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy most conventional mortgages from lenders. These guidelines create uniform standards for credit scores, debt ratios, and documentation, but lenders add their own requirements on top (called overlays) that can make qualification harder or easier depending on where you apply.

Private lender standards and flexibility

Your conventional loan approval depends on your lender's specific overlays plus the baseline Fannie Mae and Freddie Mac rules. Some lenders accept 620 credit scores while others require 640 or higher for the same loan program. Private mortgage insurance companies also influence approval since they insure loans with less than 20 percent down, and each insurer has different risk tolerances for credit scores and debt ratios. This creates more variability in conventional loan offers than FHA, where government standards apply more uniformly across all lenders. The difference between FHA and conventional loans shows up clearly here because conventional lenders take on more direct risk and adjust their requirements accordingly.

Qualification requirements

You need a minimum 620 credit score for most conventional programs, though you'll get better rates at 680 and above. Lenders verify your income through W2s, tax returns, pay stubs, and bank statements following stricter documentation rules than FHA in most cases. Your debt to income ratio typically maxes out at 43 percent for automated underwriting approval, though manual underwriting can stretch to 45 percent with strong compensating factors like high credit scores or large cash reserves. Recent bankruptcies require a four year waiting period for conventional loans (versus two years for FHA), and foreclosures need seven years of seasoning in most cases. You must prove your down payment and closing costs came from acceptable sources, and gift funds need proper documentation showing the donor's ability to give.

Best candidates for conventional loans

Conventional loans favor borrowers with credit scores above 680 who can put down at least 10 percent. You benefit most if you plan to reach 20 percent equity within a few years through payments or appreciation, since dropping mortgage insurance saves significant money compared to FHA's lifetime premium. Higher earners with lower debt ratios also prefer conventional loans because the stricter qualification standards translate into better interest rates than FHA in many cases.

Conventional loans cost more upfront through higher credit and down payment requirements, but they save you money long term by eliminating mortgage insurance once you hit 20 percent equity.

Costs that matter most for monthly payment

Your monthly mortgage payment breaks down into principal, interest, mortgage insurance, property taxes, and homeowners insurance. The difference between FHA and conventional loans shows up most clearly in interest rates and mortgage insurance costs, which together determine whether you save or spend more each month. A lower interest rate paired with expensive lifetime mortgage insurance can cost more than a slightly higher rate with cheaper insurance that drops off later.

Interest rate differences

FHA loans often carry slightly higher interest rates than conventional loans for borrowers with good credit. You might see a 0.25 to 0.5 percent rate difference when comparing FHA to a conventional loan with 20 percent down. This gap exists because FHA accepts higher risk profiles with lower credit scores and smaller down payments, which lenders price into the rate even with government insurance backing. Conventional loans reward strong credit with better rates, so a borrower with a 740 credit score typically gets a rate 0.5 to 0.75 percent lower than someone with a 620 score. That rate difference adds up quickly on monthly payments, especially on larger loan amounts.

Monthly mortgage insurance costs

Your FHA mortgage insurance premium (MIP) divides between an upfront 1.75 percent charge and an annual premium between 0.45 and 1.05 percent of your loan balance. On a $300,000 FHA loan with 3.5 percent down, you pay roughly $250 to $300 monthly for mortgage insurance that never cancels if you put down less than 10 percent. Conventional private mortgage insurance (PMI) costs between 0.3 and 1.5 percent annually based on your credit score and down payment, which translates to $75 to $375 monthly on the same loan amount. Borrowers with 680+ credit scores and 10 percent down pay significantly less for conventional PMI than FHA MIP, and they can cancel it once equity reaches 20 percent.

The monthly mortgage insurance difference between FHA and conventional loans can range from $100 to $200 per month, which adds up to $1,200 to $2,400 annually that you could save with the right loan choice.

Comparing total monthly costs

You need to calculate principal, interest, and mortgage insurance together to see your true monthly commitment. A $350,000 FHA loan at 6.5 percent with $287 monthly MIP creates a $2,500 total payment. The same loan amount as a conventional mortgage at 6.25 percent with $175 monthly PMI costs $2,330 monthly, saving you $170 each month. Property taxes and homeowners insurance stay the same regardless of loan type, so focus your comparison on the components that actually differ between FHA and conventional financing.

Property rules, appraisals, and seller concerns

The difference between FHA and conventional loans extends beyond your wallet into the physical condition of the property you want to buy. FHA requires homes to meet strict safety and habitability standards before closing, while conventional loans allow more flexibility with property condition. Sellers often prefer conventional offers because they face fewer appraisal hurdles and repair demands, which means your loan choice directly affects how competitive your offer looks in a multiple bid situation.

FHA property standards and appraisals

FHA appraisers must verify that the home meets HUD Minimum Property Standards before you can close. These rules require working heating systems, functional roofs without missing shingles, proper drainage around the foundation, and safe electrical systems. You can't close on a property with peeling paint in homes built before 1978, broken windows, missing handrails on stairs, or evidence of wood destroying insects. The appraiser flags these issues as required repairs that the seller must complete before your lender releases funds. Many sellers reject FHA offers because they don't want to spend money fixing items that wouldn't block a conventional loan closing.

FHA appraisals protect you from buying a house with serious defects, but they can kill deals when sellers refuse to make required repairs or when multiple buyers compete with cleaner conventional offers.

Conventional appraisal requirements

Conventional appraisers focus primarily on determining market value rather than enforcing strict property standards. They note obvious safety hazards and major defects, but they won't require repairs for cosmetic issues like peeling paint or minor maintenance items. Your lender reviews the appraisal to confirm the property provides adequate collateral for the loan amount, which gives both you and the seller more flexibility to negotiate who handles repairs after closing. This lighter touch makes conventional loans more attractive to sellers who want quick closings without repair negotiations.

Seller perceptions and offer strength

Sellers and their agents view conventional offers as less risky than FHA offers in competitive markets. A conventional buyer with 20 percent down signals stronger finances and eliminates the mortgage insurance appraisal layer that can create unexpected repair demands. FHA buyers face additional scrutiny during negotiations because sellers worry about deals falling apart over appraisal condition requirements. You can strengthen an FHA offer by including a larger earnest money deposit, writing a personal letter to the seller, or offering to cover certain repairs yourself up to a specific dollar limit. Some sellers won't accept FHA offers at all when they receive multiple bids, which limits your options in hot markets even when you qualify for the loan.

How to choose the right loan for your situation

Your loan choice depends on three main factors: your current credit score, how much cash you have available for down payment and closing costs, and how long you plan to own the property. Run the numbers on both loan types to see your total costs over 5, 10, and 30 years rather than focusing only on the monthly payment. The difference between FHA and conventional loans becomes clear when you calculate what each option actually costs you in interest and mortgage insurance over the time you'll keep the loan.

When FHA makes sense

Choose an FHA loan if your credit score sits between 580 and 680 and you need to preserve cash for moving costs and home repairs after closing. You benefit most when you can only afford the minimum 3.5 percent down payment and can't qualify for conventional financing at competitive rates. FHA also works better if you carry higher monthly debts that push your debt to income ratio above 40 percent, since conventional lenders get stricter at those levels. First time buyers often find FHA easier to qualify for when they lack extensive credit history or have student loans that conventional underwriting counts more heavily.

When conventional wins

Pick a conventional loan if you have a 680+ credit score and can put down at least 10 percent without draining your emergency fund. Your savings grow significantly when you reach 20 percent down because you skip mortgage insurance entirely, cutting $150 to $300 from your monthly payment compared to FHA. Conventional loans also make sense if you plan to build equity quickly through extra principal payments or expect home appreciation in your market, since you can cancel PMI once you hit 20 percent equity through any combination of paydown and value increases.

Borrowers who can reach 20 percent equity within five years through payments or appreciation typically save $15,000 to $30,000 over that period by choosing conventional over FHA.

Running your own numbers

Request loan estimates from multiple lenders for both FHA and conventional options to compare actual costs. Add up your total monthly payment including principal, interest, mortgage insurance, taxes, and insurance for each scenario. Calculate how much you'll pay in mortgage insurance over 5 years with FHA versus conventional, then factor in the difference in interest rates and upfront costs. Most borrowers find that conventional loans cost less if they can afford 10 percent down and have credit scores above 680, while FHA wins when cash and credit constraints limit conventional approval.

Next steps before you apply

Start by checking your credit score through a free service or your credit card issuer to see where you stand between FHA and conventional qualification tiers. Pull together two years of tax returns, recent pay stubs, and bank statements showing your down payment funds and reserves. Calculate your debt to income ratio by dividing your total monthly debts (including your estimated mortgage payment) by your gross monthly income to confirm you fall under 43 percent for most programs.

Contact multiple lenders to compare both FHA and conventional loan estimates side by side with your actual numbers. The difference between FHA and conventional loans becomes crystal clear when you see real quotes showing rates, monthly payments, and total costs over your expected ownership timeline. Get personalized guidance on which mortgage option fits your situation and discover strategies to strengthen your application before you submit. Lock in your pre-approval letter before house hunting to negotiate from a position of strength with sellers.